GST Registration @ ₹999

Register your business for GST at just ₹999 with expert assistance.

✅ 100% Online Process

✅ Expert Guidance at Every Step

✅ Get Your GSTIN in Just 2 Days

🚀 Fast & Hassle-Free

🔒 Secure & Reliable

🤝 Trusted by 1,000+ Businesses

💡 No Hidden Charges

Posted onTrustindex verifies that the original source of the review is Google. I had such a Supportive & Best Experience & I'm Very Grateful for it. Everyone should have this Guidance. Much a Knowledge Person ❤️🙏🏻😇Posted onTrustindex verifies that the original source of the review is Google. Bhot accha haiPosted onTrustindex verifies that the original source of the review is Google. Best clear, and professional audit.Posted onTrustindex verifies that the original source of the review is Google. Dependable and efficient audit servicePosted onTrustindex verifies that the original source of the review is Google. Amazing experience, quick ITR filingPosted onTrustindex verifies that the original source of the review is Google. Filed my ITR Smoothly and Accurately.Posted onTrustindex verifies that the original source of the review is Google. Fast and reliable filing.Posted onTrustindex verifies that the original source of the review is Google. Audit handled very smoothlyPosted onTrustindex verifies that the original source of the review is Google. Best workPosted onTrustindex verifies that the original source of the review is Google. Great guidance during our audit

Replaces The Following Indirect Taxes:

- Service Tax

- State VAT

- Central Excise Duty

- Additional Duties of Excise

- Additional Duties of Customs

- Special Additional Duty of Customs

- Cesses and Surcharges

Benefits of GST Registration in Ahmedabad

- Simplified Tax Compliance: GST registration in Ahmedabad removes the cascading effect of multiple taxes under the old system. This reduces the overall tax burden and makes tax calculations easier.

- Enhanced Credit Flow: With input tax credit (ITC), businesses can claim credit for the GST paid on purchases against the GST they collect on sales. This improves cash flow and lowers the final tax liability.

- Wider Market Reach: GST registration allows businesses to buy and sell across states without paying extra inter-state taxes. This opens the door to more customers and bigger market access.

- Improved Brand Image: Registration shows that a business is legitimate and follows tax rules. This builds trust with customers and partners.

- Reduced Tax Burden: Exporters and businesses dealing in exempt services often pay less overall tax under GST compared to the old s

Eligibility for GST Registration

- GST registration is mandatory if your annual turnover crosses a certain limit. For most businesses: ₹40 lakh turnover limit for goods within a state.,₹20 lakh for services within a state.

- Inter-state suppliers, e-commerce businesses, and sellers on e-commerce platforms must also register regardless of turnover.

- In special category states (e.g., Arunachal Pradesh, Manipur, Mizoram, Nagaland, Sikkim, Tripura, Meghalaya, Uttarakhand, etc.), the threshold is ₹10 lakh.

- Voluntary Registration: Even if your turnover is below the limit, you can register voluntarily. This helps in claiming ITC, selling across India, and boosting your brand credibility.

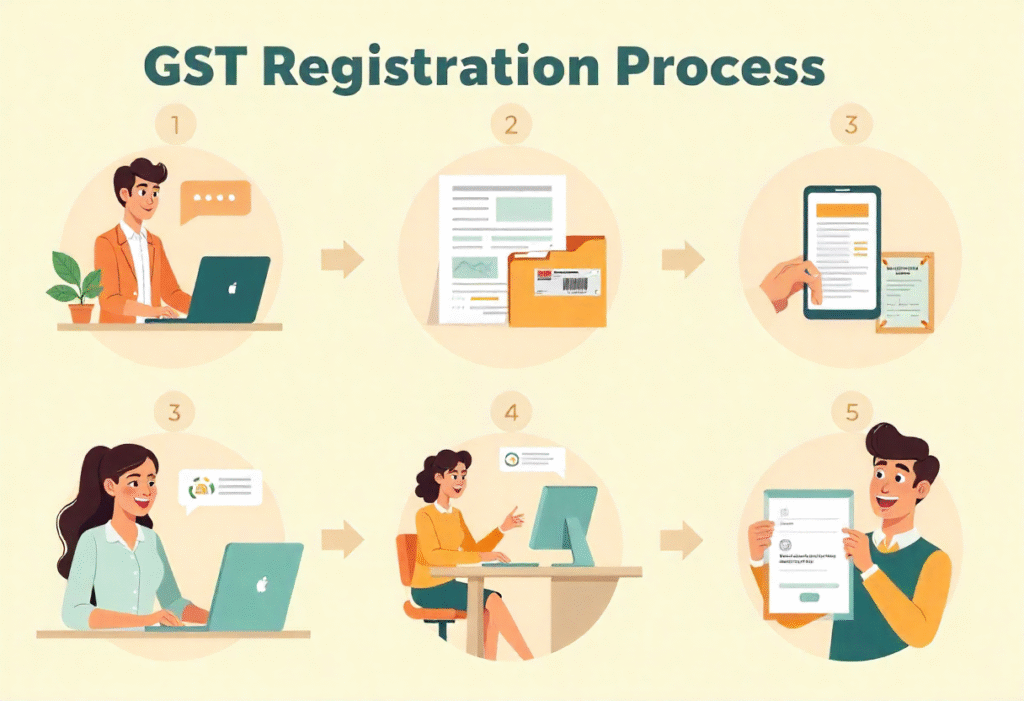

GST Registration Process

Registering may seem complicated, but with Return File it’s smooth and hassle-free:

- Consultation with Our Experts: Book a free consultation with our GST specialists. We’ll explain everything clearly and answer your questions.

- Document Collection: We’ll give you a checklist of documents like PAN, Aadhaar, business registration proof, address proof, and bank details.

- Online Registration: Our team fills out and submits your application online with accuracy.

- OTP Verification: You’ll get an OTP on your registered phone/email to verify your application.

- Get Your ARN & GSTIN: After successful submission, you’ll receive an Application Reference Number (ARN) and later your GSTIN certificate.

What is a GSTIN?

A GSTIN (Goods and Services Tax Identification Number) is a 15-digit unique ID given to every registered taxpayer.

- First 2 digits: State code (e.g., 07 for Delhi, 27 for Maharashtra).

- Next 10 digits: Your PAN number.

- 13th digit: Number of registrations linked to that PAN in the state.

- 14th digit: A check digit for data security.

Why is GSTIN Important?

- Compliance & Legitimacy: Shows your business is legally registered and trustworthy.

- Input Tax Credit (ITC): Lets you claim GST paid on purchases.

- Tax Invoices: You must mention GSTIN on all invoices for customers to claim ITC.

- Return Filing: Required for filing GST returns.

- Inter-state Trade: Mandatory for supplying goods or services across states.

Documents Required for GST Registration?

Mandatory Documents:

- PAN Card

- Aadhaar Card

- Business registration proof (for companies/LLPs)

- Address proof (Electricity Bill, Rent Agreement + NOC, Property Tax Receipt, etc.)

- Bank details (Cancelled cheque or bank statement)

Additional Documents for Companies/LLPs:

- Digital Signature Certificate (DSC)

- Authorization Letter from directors/partners

- Passport-size photos of applicant and authorized signatory

Why Choose Return File?

- Experienced Team: Skilled accountants with years of expertise.

- Wide Range of Services: Tax filing, GST help, business compliance, and more.

- Tailored Solutions: Custom advice for your specific business.

- Easy & Convenient: Simple-to-use platform.

- Trusted by Many: Reliable service with strong client relationships.

- Clear Communication: We explain everything in plain language.

- Future-Ready: Latest technology and methods for smooth service.

FAQs about GST Registration

Q1. What happens after I register for GST?

Once you get your GSTIN, you must issue GST invoices for sales, file GST returns regularly, and pay your tax after adjusting ITC.

Q2. What are the penalties for not registering for GST when it’s mandatory?

If you don’t register, you may face a penalty of 10% of the tax due (minimum ₹10,000). In cases of fraud, the penalty can go up to 100% of the tax due.

Q3. Can I cancel my GST registration later?

Yes. You can apply for cancellation if your business closes, your turnover falls below the threshold, or if you voluntarily want to deregister.

Q4. What is the benefit of GST registration?

It gives you legal recognition, allows ITC claims, helps expand your market reach, and builds credibility with customers.

Q5. What are some common mistakes people make during GST registration?

Entering wrong details in the application.

Uploading incorrect or unclear documents.

Using mismatched information (e.g., PAN vs Aadhaar).

Not updating business details after changes.

Copyright © 2025 Returnfile.in | Design By Digiprox Media.